A person accused of tax fraud or evasion must prove intent and knowledge, which is usually difficult to establish. An effective tax lawyer can work to show that the government did not actually do what was reported and did not intend to pay the taxes in question. Additionally, the penalties for evasion and fraud are severe, so it is important to have effective representation. A criminal defense attorney can also help you to fight back against accusations of evasion, which can be very difficult to defend against.

While the government must prove that a defendant owes a substantial amount of tax, they do not need to prove that he or she intentionally violated the law. If the government can prove that the defendant was aware of their debt and intended to avoid paying it, then it is a strong case. A tax fraud attorney will help to show that the accused person knew the law and knowingly and purposefully avoided paying taxes.

While the government must prove that a defendant owes a substantial amount of tax, they do not need to prove that he or she intentionally violated the law. If the government can prove that the defendant was aware of their debt and intended to avoid paying it, then it is a strong case. A tax fraud attorney will help to show that the accused person knew the law and knowingly and purposefully avoided paying taxes.

There are several penalties associated with tax evasion. Failure to file a tax return carries civil and criminal penalties. Filing a fraudulent tax return carries up to 3 years in jail and a maximum fine of $100,000. In addition, misrepresenting financial information on a tax return can result in a sentence of up to $250,000, and it can also cost you your home. The only way to protect yourself from these consequences is to hire a top Olathe tax fraud and evasion defense attorney today. The benefits of hiring a legal professional to handle your case are great.

In the event of a tax fraud or evasion conviction, you must seek the legal assistance of a qualified attorney. Whether you are accused of tax evasion, filing a return with incorrect information, or requesting a refund, a skilled attorney will be able to protect you. If you have been wrongfully withheld taxes, you must pay it back to the IRS. You will not only lose your money, but you will also risk jail time.

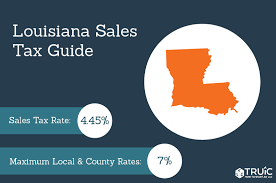

The most important part of Tax Fraud and evasion defense is to hire a lawyer who specializes in this area of law. The right attorney will be able to guide you through the entire process from beginning to end and ensure that you are treated fairly. Your lawyer will be able to help you find a way to repay the debt without a trial. You may even be able to avoid criminal charges if your taxes were filed in the wrong place. Click here to consult to a Louisiana tax lawyer.

The best way to handle a tax fraud and evasion case is to contact an attorney who specializes in this area of law. A good lawyer can represent you in court against the tax authorities and get the charges dismissed. They will be able to fight for your rights and make the prosecution look inexplicable. They can help you find the best way to avoid jail time and avoid a criminal conviction. It’s essential to have an attorney who specializes in this area of tax law.

One of the best ways to defend against tax evasion charges is to hire an experienced attorney. Choosing a lawyer that has extensive experience in this area will give you the best chance of success. The tax fraud and evasion attorney will be able to help you understand the ins and outs of the tax law, as well as the consequences and benefits of a successful tax fraud defense. You can also consult with a local tax attorney and discuss your situation with them.

In some cases, a tax evasion lawyer will be able to defend your rights and help you avoid penalties. If your tax fraud case is dismissed, you may need to hire an IRS attorney in Louisiana to defend yourself. You should be sure to choose a law firm with a proven record of  success in defending people against tax evasion charges. A professional will be able to help you avoid a criminal conviction and protect your rights.

success in defending people against tax evasion charges. A professional will be able to help you avoid a criminal conviction and protect your rights.